How Much Money Do Your Parents Have To Make To Get Fafsa

Parents sometimes wonder if it's worthwhile to file the Free Application for Federal Student Aid (FAFSA), especially if they think their income is too loftier to qualify for demand-based federal financial aid. Only, there are no simple FAFSA income limits, or income cutoffs on fiscal aid eligibility, in part due to the complexity of fiscal assist formulas.

Unless the parents earn more than $350,000 a year, take but i child and that child will enroll at an in-land public college, they should nevertheless file the FAFSA form, every bit there is a expert take a chance they may qualify for federal educatee help or land or institutional grants. They may as well qualify for low-cost federal loans and federal work-study.

Even if a college uses the CSS Profile to make up one's mind institutional aid eligibility, the student must nonetheless file the FAFSA to use for federal fiscal help.

Use our Financial Assistance Calculator to estimate the expected family contribution (EFC) and your fiscal demand.

Intuition is Inaccurate

Parents have a trend to underestimate eligibility for demand-based assistance and overestimate eligibility for merit-based aid.

Eligibility for need-based help depends on more than merely income. Important factors include the cost of the college, the number of children enrolled in college at the same time, family unit size, special circumstances that affect the family's power to pay for higher and whether or not the student is a dependent student. Student income and avails are assessed more heavily than parent income and assets. Graduate students are eligible to infringe a larger amount of federal student loans than undergraduate students. Financial aid formulas are likewise more focused on cash catamenia than on income.

Academic functioning is non enough to distinguish a educatee from his or her peers, especially at the most selective colleges. There are more than 80,000 valedictorians and salutatorians each year. Grade inflation and weighted GPAs contribute to more than high schoolhouse students having a four.0 (or better!) GPA on a 4.0 scale. Thousands of students become a perfect score on the Sat and ACT each year. Tens of thousands of students go at to the lowest degree a 1500 on the SAT and a 33 or better on the ACT.

Students must make satisfactory academic progress to qualify for federal financial aid, merely they shouldn't count on good grades to pay for higher.

Apply for Fiscal Assistance Every Year

Information technology is important to submit a financial help application every yr, even if you did non get annihilation other than a student loan last year. There are subtle factors that can touch eligibility requirements for demand-based fiscal aid. These factors can change from one year to the side by side. Congress tinkers with the financial assistance formulas periodically. If you don't file the FAFSA every year, you might miss out on fiscal aid.

Financial aid is based on financial need, which is the difference between the cost of attendance (COA) and the expected family contribution (EFC). Financial need increases when the COA increases and when the EFC decreases.

Thus, a educatee who enrolls at a higher-cost college might qualify for some financial aid, while the same student might authorize for no financial aid at a low-toll college, such as an in-country public college.

The parent contribution function of the EFC is divided by the number of children enrolled in higher at the same fourth dimension. When the number of children in college increases from one to ii, it is almost like dividing the parent income in half, which can authorize both children for much more financial assistance than either could qualify for on their own.

For example, when the oldest child enrolls in college for the kickoff time, that child might non authorize for much college fiscal aid. Nonetheless, when the oldest and second oldest children both enroll in college at the aforementioned fourth dimension, the number of children in higher increases from one to 2, potentially qualifying them for more financial assist.

Thus, there are no clear FAFSA income limits. Eligibility for need-based financial aid depends on more than just income.

See also: Complete Guide to Financial Assist and FAFSA

Eligibility for Grants

In that location is no explicit income cutoff on eligibility for the Federal Pell Grant. Eligibility for the Federal Pell Grant is based on the expected family contribution (EFC), not income.

Based on data from the National Postsecondary Student Aid Written report (NPSAS), more than 94% of Federal Pell Grant recipients in 2015-16 had an adjusted gross income (AGI) under $lx,000 and 99.nine% had an AGI under $100,000.

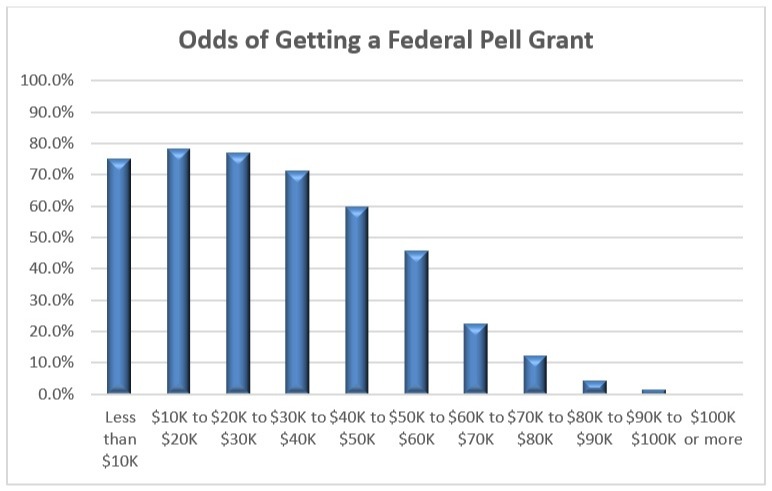

The odds of receiving a federal grant decrease with increasing income, as shown in this chart.

As noted to a higher place, a family with two or more children in college may qualify for a Federal Pell Grant considering the parent contribution is divided by the number of children in college. Also, the family may have special circumstances that affect their power to pay for college.

Eligible students may also authorize for other forms of financial aid, such equally institutional grants. For example, some students whose parents earn $100,000 or more will qualify for grants from their college. For case, almost a third (32.9%) of students whose parents earn six-figure salaries received institutional grants. A fifth (21.4%) received merit-only grants and a tenth (11.6%) received demand-based grants.

Some colleges require students who are applying just for merit help to file the FAFSA, just to make sure they go any need-based help for which they are eligible. Colleges often use need-based aid to offset part of a merit-based grant or scholarship.

If there is any question as to whether a pupil might authorize for financial help, employ the college's net price calculator to go an estimate as to how much gift assistance the student might become.

How Many Students Pay Total Sticker Price?

Based on 4-year college data from the Integrated Postsecondary Teaching Data Organization (IPEDS), a quarter of freshmen and a tertiary of all undergraduate students pay full sticker price. Slightly less than one-half got no institutional grants.

At Ivy League colleges, half of freshmen and all undergraduate students pay full sticker price, and slightly more than half go no institutional grants. Generally, the percent of undergraduate students paying total sticker price increases with greater selectivity. Simply, among the well-nigh selective colleges, fewer undergraduate students pay total sticker cost at MIT, Stanford and Princeton.

Counter-intuitively, undergraduate students at 4-year public colleges and lower-price colleges are more likely to pay full price than students at individual colleges. Two-fifths of undergraduate students at public colleges pay full sticker cost, compared with a quarter of students at private colleges.

Overall, a tertiary of students at 4-year colleges pay full price, compared with almost half of students at customs colleges.

The lower cost at public colleges causes fewer students to authorize for financial aid, especially amidst high-income students.

Family income affects where the students enroll.

- Students from high-income families enroll in colleges where 3-fifths of undergraduate students pay total price

- Students from low-income families enroll in colleges where a third of undergraduate students pay full price

The aforementioned is true even when the information is express to Bachelor'south degree programs, where the proportions are one-half and a quarter, respectively.

The FAFSA is a Prerequisite for Federal Loans

Even if a student will not qualify for grants, filing the FAFSA makes them eligible for depression-cost federal student loans, which are unremarkably less expensive than private pupil loans. Even wealthy students will qualify for the unsubsidized Federal Direct Stafford Loan and the Federal Parent PLUS Loan. The Federal Stafford Loan is a expert way for the student to have skin in the game, since they are unlikely to over-borrow with but a federal pupil loan.

Store Smarter For College

Come across your personalized affordability profile for 3 schools and detect out how much you might demand to borrow with the free MyCAP tool from College Aid Pro If you desire to get a personal coaching session or advanced features, use SFC15 for a xv% discount!

When is it OK to Non File the FAFSA?

There are a handful of situations in which the family unit probably does not qualify for need-based financial aid, including families who:

- Tin afford to pay for college tuition with pocket modify

- Are in the top one percent past income or wealth

- Who have donated a building or two to the higher

Upcoming FAFSA Changes

Significant changes are coming to FAFSA requirements, which volition touch financial aid eligibility for many students. These changes include eliminating the "discount" for parents with multiple students in higher, and replacing the EFC with the Student Aid Alphabetize. The Section of Ed volition implement the changes in stage, kickoff with the 2021-22 academic year, with a scheduled completion date of 2024-25.

Run into also: How FAFSA Simplification Will Change Financial Aid Eligibility

If college is years away, it tin can be difficult to predict how much fiscal aid your child volition qualify for. That's why it'due south of import to salvage as much as possible in a 529 programme. Just, if your savings come up brusk and you lot've wearied all of your federal student loan options, you may want to consider a private student loan to encompass the remaining costs.

Source: https://www.savingforcollege.com/article/is-there-an-income-cutoff-on-eligibility-for-financial-aid

Posted by: fortnerstoult.blogspot.com

0 Response to "How Much Money Do Your Parents Have To Make To Get Fafsa"

Post a Comment